WORLD NEWS FLASH

UNITED STATES

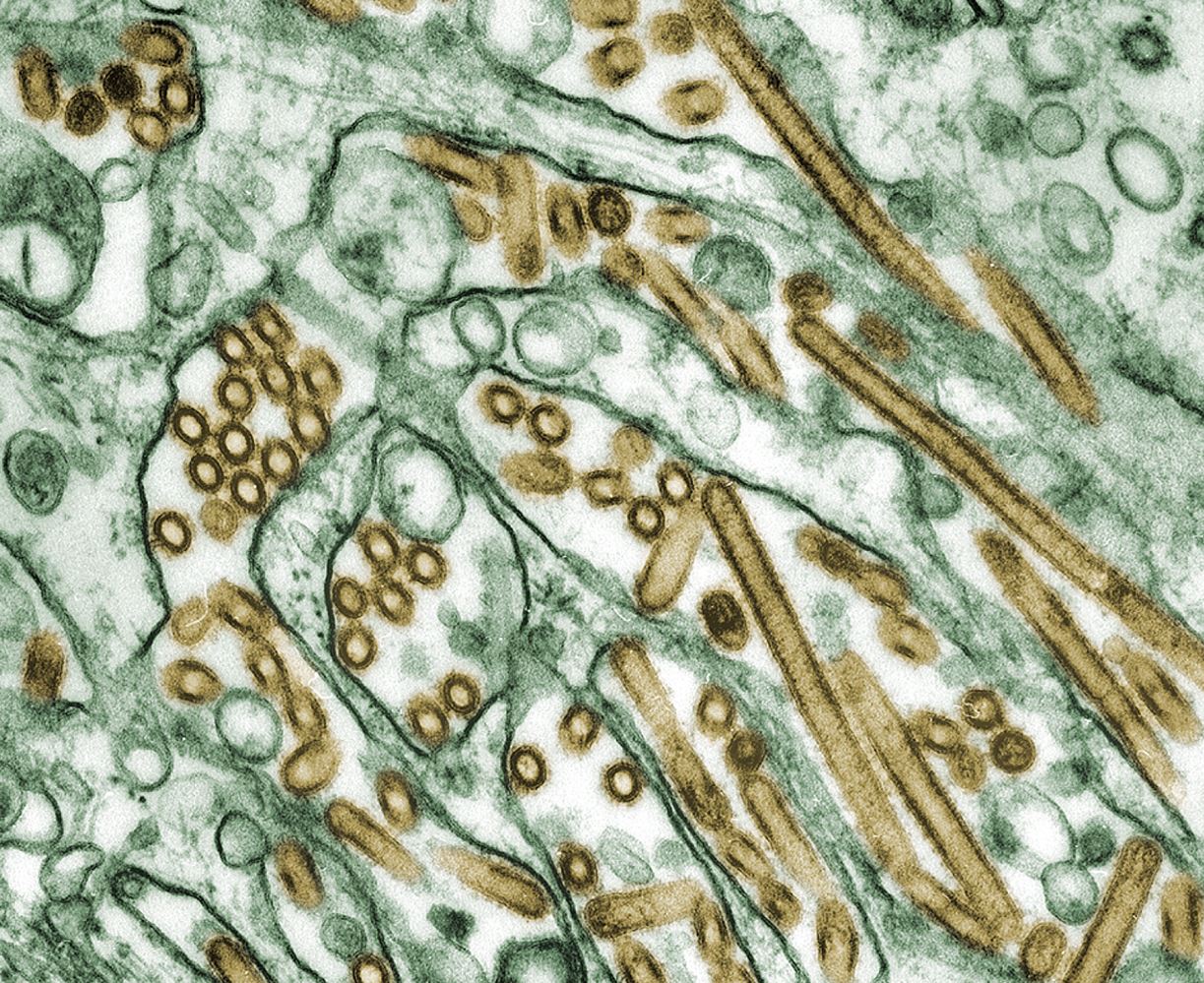

The Louisiana Department of Health reports the patient who had been hospitalized with the first human case of highly pathogenic avian influenza (HPAI), or H5N1, in Louisiana and the U.S. has died. The patient was over the age of 65 and was reported to have underlying medical conditions. The patient contracted H5N1 after exposure to a combination of a non-commercial backyard flock and wild birds.

LDH’s extensive public health investigation has identified no additional H5N1 cases nor evidence of person-to-person transmission. This patient remains the only human case of H5N1 in Louisiana.

The Department expresses its deepest condolences to the patient’s family and friends as they mourn the loss of their loved one. Due to patient confidentiality and respect for the family, this will be the final update about the patient.

While the current public health risk for the general public remains low, people who work with birds, poultry or cows, or have recreational exposure to them, are at higher risk.

The best way to protect yourself and your family from H5N1 is to avoid sources of exposure. That means avoiding direct contact with wild birds and other animals infected with or suspected to be infected with bird flu viruses.

Protecting yourself and others from H5N1 infection

- Do not touch sick or dead animals or their droppings and do not bring sick wild animals into your home.

- Keep your pets away from sick or dead animals and their feces.

- Do not eat uncooked or undercooked food. Cook poultry, eggs and other animal products to the proper temperature and prevent cross-contamination between raw and cooked food.

- Avoid uncooked food products such as unpasteurized raw milk or cheeses from animals that have a suspected or confirmed infection.

- If you work on poultry or dairy farms, talk to your provider about getting your seasonal flu vaccination. It will not prevent infection with avian influenza viruses, but it can reduce the risk of coinfection with avian and flu viruses.

- Report dead or sick birds or animals to the USDA toll-free at 1-866-536-7593 or the Louisiana Department of Agriculture and Forestry Diagnostic Lab at 318-927-3441.

If you have been exposed to sick or dead birds or other animals or work on a farm where avian influenza has been detected, watch for respiratory symptoms or conjunctivitis. If you develop symptoms within 10 days after exposure to sick or dead animals, tell your healthcare provider that you have been in contact with sick animals and are concerned about avian influenza. This will help them give you appropriate advice on testing and treatment. Stay home and away from others while you have symptoms.

MASS SHOOTING UPDATE

Information recent as of 12-31-2024

2024 Mass Shooting Stats: (Source: Mass Shooting Tracker – https://www.massshootingtracker.site/data/?year=2024)

- Total Mass Shootings: 573

- Total Dead: 693

- Total Wounded: 2363

- Shootings Per Day: 1.61

- Days Reached in Year 2024 as of December 31: 366

CANADA

PRIME MINISTER STEPPING DOWN

After 10 years of leading America’s neighbor up north, the man in charge is pulling a Biden of sorts.

On Jan. 6, Canadian Prime Minister Justin Trudeau announced that he would be stepping down from his post, triggering a search for a new leader in an upcoming election.

Here now is a transcript of Trudeau’s remarks in English.

“Every morning, I’ve woken up as prime minister, I’ve been inspired by the resilience, the generosity and the determination of Canadians. It is the driving force of every single day I have the privilege of serving in this office.

“That is why, since 2015, I’ve fought for this country – for you – to strengthen and grow the middle class, why we rallied to support each other through the pandemic, to advance reconciliation, to defend free trade on this continent, to stand strong with Ukraine and our democracy, and to fight climate change and get our economy ready for the future.

“We are at a critical moment in the world. My friends, as you all know, I’m a fighter. Every bone in my body has always told me to fight because I care deeply about Canadians, I care deeply about this country, and I will always be motivated by what is in the best interest of Canadians.

“And the fact is, despite best efforts to work through it, Parliament has been paralyzed for months after what has been the longest session of a minority parliament in Canadian history.

“That’s why… I advised the Governor General that we need a new session of Parliament. She has granted this request, and the House will now be prorogued until March 24.

“Over the holidays, I’ve also had a chance to reflect and have had long talks with my family about our future. Throughout the course of my career, any success I have personally achieved has been because of their support and with their encouragement.

“So last night, over dinner, I told my kids about the decision that I’m sharing with you today.

“I intend to resign as party leader, as prime minister, after the party selects its next leader through a robust, nationwide, competitive process. Last night, I asked the president of the Liberal Party to begin that process.

“This country deserves a real choice in the next election, and it has become clear to me that if I’m having to fight internal battles, I cannot be the best option in that election.

“The Liberal Party of Canada is an important institution in the history of our great country and democracy. A new prime minister and leader of the Liberal Party will carry its values and ideals into that next election. I’m excited to see the process unfold in the months ahead.

“We were elected for the third time in 2021 to strengthen the economy post-pandemic and advance Canada’s interests in a complicated world, and that is exactly the job that I – and we – will continue to do for Canadians.”

UNITED KINGDOM

THE TAX MAN COMETH

With less than a month to go, the countdown is on for 5.4 million customers who still need to complete and pay their Self Assessment and avoid penalties, HM Revenue and Customs (HMRC) warns.

Thousands of taxpayers have already done so by completing their tax returns before the fizz was barely flat on New Year’s Day. HMRC can today reveal more than 24,800 people filed on January 1. A further 38,000 had even squeezed theirs in before the bells on December 31, with 310 filing between 23:00 and 23:59.

Filing your tax return and paying on time plays an important role in supporting public services and the government’s Plan for Change, which is delivering economic stability and investment across the UK. Anyone who is yet to file their tax return can do so online, via GOV.UK.

Anyone required to file a tax return for the 2023 to 2024 tax year who misses the January 31, 2025 deadline could face an initial late filing penalty of £100.

Myrtle Lloyd, HMRC’s Director General for Customer Services, said, “We know completing your tax return isn’t the most exciting item on your New Year to-do list, but it’s important to file and pay on time to avoid penalties or being charged interest.

“The quickest and easiest way to complete your tax return and pay any tax owed is to use HMRC’s online services – go to GOV.UK and search ‘Self Assessment’ to get started now.

“Some 97% of customers now file online and one benefit is that they don’t have to complete it all in one go – they can save what they have done and pick it up again later.”

Once a tax return is filed, payments can also be made quickly and securely through the HMRC app. Customers can set up notifications in the app to remind them when payments are due, so they don’t need to worry about missing deadlines or penalties. Information about the different ways to pay, can be found on GOV.UK.

For people who can’t meet the tax return deadline, HMRC will treat those with reasonable excuses fairly if they tell us before January 31.

The penalties for late tax returns are:

- An initial £100 fixed penalty, which applies even if there is no tax to pay, or if the tax due is paid on time

- After 3 months, additional daily penalties of £10 per day, up to a maximum of £900

- After 6 months, a further penalty of 5% of the tax due or £300, whichever is greater

- After 12 months, another 5% or £300 charge, whichever is greater

There are also additional penalties for paying late of 5% of the tax unpaid at 30 days, 6 months and 12 months. If tax remains unpaid after the deadline, interest will also be charged on the amount owed, in addition to the penalties above.

If someone regularly sells goods or provides services through an online platform, they may need to pay tax on their income. Customers can find out more about selling online and paying taxes on GOV.UK by searching ‘online platform income’ or by downloading the HMRC app. The guidance will help them decide if their activity should be treated as a trade and if they need to complete a Self Assessment tax return.

You also may need to file a return if you:

- Are newly self-employed and have earned gross income over £1,000

- Earned below £1,000 but wish to pay Class 2 National Insurance Contributions voluntarily to protect your entitlement to State Pension and certain benefits

- Are a new partner in a business partnership

- Have received any untaxed income over £2,500

- Receive Child Benefit payments and need to pay the High Income Child Benefit Charge because you or your partner earned more than £50,000

Criminals use emails, phone calls and texts to try to steal information and money from taxpayers. Before sharing personal or financial details, people should search ‘HMRC tax scams’ on GOV.UK to access a checklist to help decide if the contact received is a scam.