THE OBSERVATION BOOTH

OP / ED BY ANDREA DIALECT

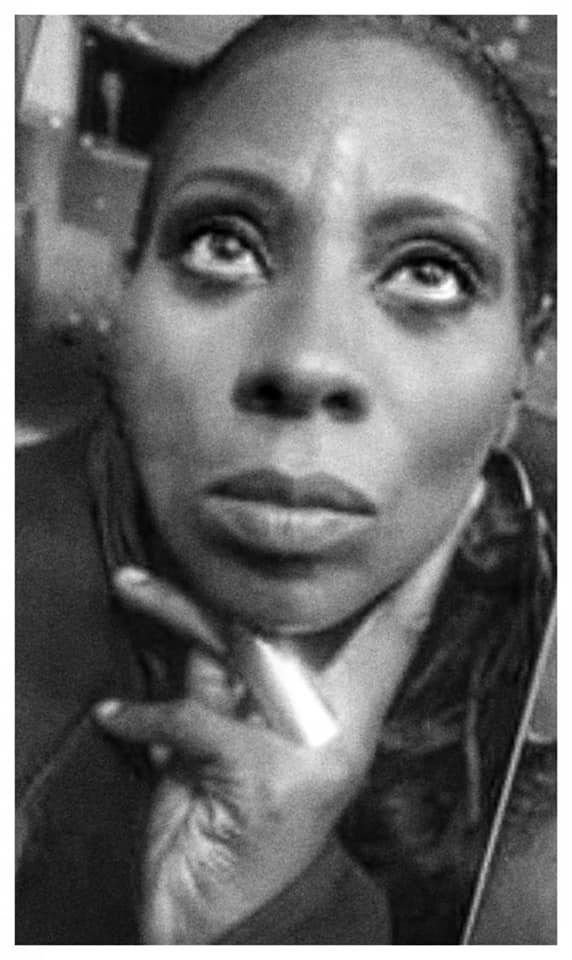

Financial Coach Keisha N. Cole

(KeishaNataleeCole.live)

(myfearlessslifebydesign@gmail.com)

Cover Photo By Andrea Dialect

Last week, I wrote a tribute to my father Mr. Julious Caesar Brown II commemorating his rise. Ironically a few days ago someone asked me if he’d left us anything. Supposedly, they were inquiring about material assets and money and thangs which were none of their business, to say the least. Yet the probing question for some reason has become galvanized in my head and I now realize even more so that for “Andrea” it most certainly needs to become more of a focus.

Money mattering is something that we all can use some of, so that’s when I thought I’d better call Keisha. I guess I’ll be as bold as that inquiring mind in want of the tea and toss the forbidden rule of no money talkin’ and sprinkle it around like confetti today.

Question: What about you and yourn? Have you anything left to leave yours, or anything left for yourself? Do you have it together for sure, somewhat or midways so or are you peeking over at that money bag or purse with the side eye like I sometimes do? Are credit cards your shanty glass house or that brick house or are bank overdrafts that apartment that ya living in and it gotcha beggin’, borrowing or doing without which is the messy relationship that you’re pondering a tip out?

For me I haven’t committed to home buying just yet, but overdraft and I sometimes hang too tight lol. WE’VE GOT TO GET IT TOGETHER!

MONEY DOES MATTER

FINANCE 101? (You’d best start) …

Keisha: Yes, you heard me right and I’ll say it again. “Start,” that is the answer and that would be my advice to any and everyone because here’s the thing: Just like me when I didn’t think that I could do anything you can and once you get into the habit of paying yourself and putting things in place for yourself then it grows and so anytime you have extra your already used to dropping it into the game plan.

That’s the first thing I always say to my clients after I’ve done a presentation or shown them some things. I talk to them about what they have going on. I always say to them listen it looks like a lot because at the end of the day to realize that you need two million to retire, that is a lot and people get intimated by that number.

If you have someone that retires at seventy, if they live twenty years a hundred thousand dollars is not taking them through twenty years of retirement. That’s why it’s so important for people to know what their financial independence numbers are because that’s how much money you’re going to need during retirement. That depends on how old you are.

We build our financial house from the ground up, right? So, the foundation has to be life insurance because you could be putting away two hundred dollars a month in an investment vehicle but if you’ve only been investing for three months and you die how much is in that vehicle?

Is six hundred dollars going to take care of your family? No, it’s not even going to bury you. So, we always start with the right foundation. Get the right insurance so if anything were to happen to you at any point while you’re building your portfolio or while you’re saving for retirement. Your family has something to help them get through for however many years you are providing for them. Because life insurance is income replacement it’s not about burial, it’s not about paying off bills or debt its income replacement and a house. It’s about income replacement because if that income is gone who’s going to pay that income?

There’s whole life insurance that’s where it has a cash value attached to it like a saving portion and then there’s term life insurance, which is life insurance just in case you die, there is no cash value attached to it’s not an all-in-one type of program. I don’t recommend the cash value policies because there are so many funny banking rules that come with that particular type of life insurance that it doesn’t make sense for us!

When the insurance agents are pushing this whole life product, they’re not telling you the whole truth, they leave out the things that matter so that they can get you to buy into it. There are so many things going around, you’re told that “you can be your own banker, you can borrow from yourself.” But why am I burrowing from myself it’s my money. Why am I burrowing from myself; it’s my money let me just take it. And if I want to borrow from it, I have to pay it back at double the interest rate that you’re giving me, and you’re only giving me three, four percent.

Three-four percent. Do you know what that means. I’m going to say this for example but it’s so much better when it’s seen. Let’s say you have a hundred dollars that you’re paying towards a policy right and you don’t even get a lot of coverage for a hundred bucks; so let’s say it’s a hundred thousand dollars. You’ll want to maybe a hundred thousand to be okay. But that one hundred dollars does not go to your investment portion, you’re saving portion, and there are fees that you have to pay. You have to pay fees to the company, and you have to pay fees to your broker.

So that’s taken out so let’s say that’s forty bucks now you have sixty dollars and let’s say twenty of that sixty goes to the broker now you have forty dollars, so that’s forty dollars that’s going into your savings not a hundred, forty. So that means that the little interest that their giving you that’s compounding off of forty bucks and that’s not going to give you a lot. Now, how long is it going to take your money to grow? A long time, and even when you start, let’s say you open up a life policy today you’re not going to earn any money in your savings for at least the first three to five years.

So you’re paying a hundred dollars into this policy, they’re investing it, and they’re making money off of you until five years later. Five years later guess where you’re starting at? Zero! They tell you “Oh if you put money into it you can borrow from it.” Yeah, if you put in that one hundred thousand or sixty thousand but who has sixty thousand just sitting in their bank account? Do you know where they tell these people to take that money from? Their retirement! “Go borrow it from your 401K.” But, now you’re taking the penalty. You borrowed it from your 401K, you’re front-loading this policy just so that you can borrow against it. But if you don’t pay it back guess what happens to your policy? It closes and now you ain’t got no money or that insurance policy.

You also have to pay attention to the type of policy that you have. It always baffles me when people are okay with being taken advantage of. What I teach my clients to do is get term life insurance number one it’s cheaper. You can get a whole lot more coverage because term life is exactly what it is just like car insurance, cell phone insurance home insurance. You’re paying into it just in case and a lot of people get caught up with. But I’m paying all this money policy and I don’t get anything back if I cancel it.

Okay, you’re paying all this money to your car insurance; if you don’t have an accident, they don’t give it back. You’re paying all this money into your house insurance; if it never burns down, you don’t get it back. Don’t look at it from the perspective that I’m paying all this money. Because the bottom line is you’ll never pay a million dollars into a million-dollar policy. If you get a million-dollar policy you’re probably going to pay a third of that over the course of the policy.

But if anything happens to you your family gets a check. People have to understand things like, what’s more, valuable to you? What’s important to you? Do you want to protect them the right way; or do you want to get something where you don’t even know what you got? Because it sounds good on paper but when you read the fine print you realize this isn’t really that good for me.

People must understand exactly what their getting because when people really understand and they’re clear about it they’re comfortable with it. That’s where we start we always start with getting that life insurance policy in place immediately because if anything were to happen to you after I’ve spoken to you and you didn’t sign up for the policy. There’s nothing that I can do for you, and I can’t do anything for your family. But if I get you protected great we start there. Then we talk about debt, we talk about emergency savings, we talk about a will because you have to make sure that you have a will in place.

A will is more than just stuff, it’s more than just assets and who’s going to get what. Depending on your family situation, who’s going to take care of my children if I passed away? A lot of times people think, “Oh my sister knows that she’s going to take care of them.” Okay, she may know that but what if your aunt whom you ain’t never heard of decides that they want to take the kids so that they can get money from the state. That aunt comes in and contests it, or your sister doesn’t want to take care of the kids.

These things you have to put on paper because if you don’t tell the state what you want to be done the state is going to tell your family what they’re going to do. Then we talk about debt, we talk about how to get out of debt quickly. We talk about paying yourself and then we talk about college savings and any other goals and dreams always come last. Because those first three buckets always come first. Life insurance, emergency savings, and retirement. Because kids have all kinds of different ways to go to school but there are no retirement loans. I called the bank, they told me no. We can’t get any scholarships for retirement we have to fund our own retirement. We have to make sure that we are taken care of first before you help the kids.

I just like when you get on an airplane, and they tell you that before you help anyone else, same thing. You’ll get to retirement age, and you’ve spent all your money on your kids. Now you don’t have any money for retirement what do you have to do? You have to keep working. So, the goal is for everybody is to make sure that I sit down with, everybody that I educate, everybody that works with me. The goal is that they have a financial game plan that they are comfortable with and that they feel good about and that they’re doing. My money reality check kicked in I believe with my being a single parent and broke. What about you?

My money reality check kicked in I believe with my being a single parent and broke. One of my girls was a part of the company and she said, “Hey I started a new business and I need to do some training; can you train with me.” I said sure, what can I do to support. Knowing that I had no money and that I knew nothing about money or how it worked, savings or investments or whatever.

So, she comes over and she sits down with me her and her trainer and they’re going through everything, and I say yes, sign me up for everything, knowing that I didn’t have a dime to put towards nothing.

But I felt so stupid because I knew that I didn’t have any life insurance, I didn’t have any savings, retirement what is that? I felt dumb! So, finally one day I say to myself okay let me go ahead and sign up for this stuff because I know that I need it. I’ve got young kids and I don’t want anything to happen to them if anything happens to me and while she’s going through it, they always offer the opportunity to do the business too because she knew that I didn’t have any money. She told me that I could make some extra income doing what she did. I declined because I didn’t want to sell life insurance because that’s what I thought it was life insurance.

But, just watching her go through life doing things on her terms, making money being able to travel; I thought about it, finally saying to myself I want to do that I’m tired of working for other people. I just got tired of it. It took me two years because I didn’t have any confidence in myself to do the business. Having her as my financial coach she was definitely helping me learn some things, putting thing in place and making sure I stayed on track. Saving and Life Insurance at the time was literally all I could afford and barely because I kept falling off and on and off and on because at the time, I wasn’t getting paid what I was worth and so I was living paycheck to paycheck.

She just made sure she kept encouraging me, she kept calling me and saying you sure you don’t want to do this she would say you would really be great at this and again I’d say no. One day I said to myself why not? If I try it out and it doesn’t work at least I’d have learned something, and I’d be getting my financials together one day I called her, and she said: “Let’s go!” Eight years later here I am.

Before becoming that financial coach, I had to get to that place mentally because it’s all mindset. It was definitely a learning curb because it was a lot but the people that I partnered with really helped me along the way. My girlfriend who was my financial coach also became my trainer and so I literally just tagged along, and she did all the work and as she did all the work, I was learning by watching how she talked to people that I introduced her to and seeing how she closed and as giving all the information.

Literally, I just practiced over and over again reading through all the scripts because they lay it all out for you there’s a system in place and as long as you follow the system, you’re going to make money. So, I kept following the system and I said I’m going to this and I’m sharing it with everybody. The passion that I had for wanting to help people and educate people drew people to me. I had a lot of folks that came with me, and I was able to help them with their income and I then was making an extra income.

My son at the time was eight and he came with me to every training. See, I plugged into as much stuff as I could because I wanted to learn everything I could, and my son would come with me; he was my biggest supporter. There were events that we’d go to, and people would have tables so that you could vend. I would do vending events and my son would pass out brochures and get them to come to the table and sign up.

He was into it as much as I was into it so it really created an environment for growth across the board at my house so that was helpful because he would come to me if I missed a training. He would bring my books to me, and say come on mom it’s time to train. According to him, he was my assistant. I made him business cards and everything. You have to include children in certain things.

A lot of times I know when growing up we weren’t included in the finances. We didn’t know anything about it. We just knew that there was a house that we got to sleep in and it was always food It was always warm in the winter and cool in the summer we didn’t know. We didn’t know how the bills got paid. “What is a bill?”So, it’s so important that we teach our children at a young age what money is all about, so they are already set up for success. It is so important that we learn ourselves. It makes for a better life for everybody!

TO BE CONTINUED!

DID YA KNOW THAT…

Why don’t people have life insurance?

When you consider the top reason for not purchasing life insurance is that it is too expensive, overestimating the true cost of coverage may deter many from purchasing it. For many underinsured individuals, it’s not that they don’t want the life insurance they need.

63% of Americans are living paycheck to paycheck — including nearly half of six-figure earners. With persistent inflation eroding wage gains, the number of Americans living paycheck to paycheck is near a historic high, according to a recent report.

30 Million Americans

Nearly 30 Million Americans Have No Health Insurance

On average, Americans have around $141,542 saved up for retirement, according to the “How America Saves 2022” report compiled by Vanguard, an investment firm that represents more than 30 million investors. However, most people likely have much less: The median 401(k) balance is just $35,345.

DO YOU KNOW ANY OF OUR COMMUNITY ACCESS CONTRIBUTORS?

If SO LET THEM KNOW THAT THEY’VE MADE THE CUT AND THEY ARE THE TALK OF LOCAL TALK THIS WEEK!

PASS IT ON!

LIKE, COMMENT, SHARE!