THE OBSERVATION BOOTH

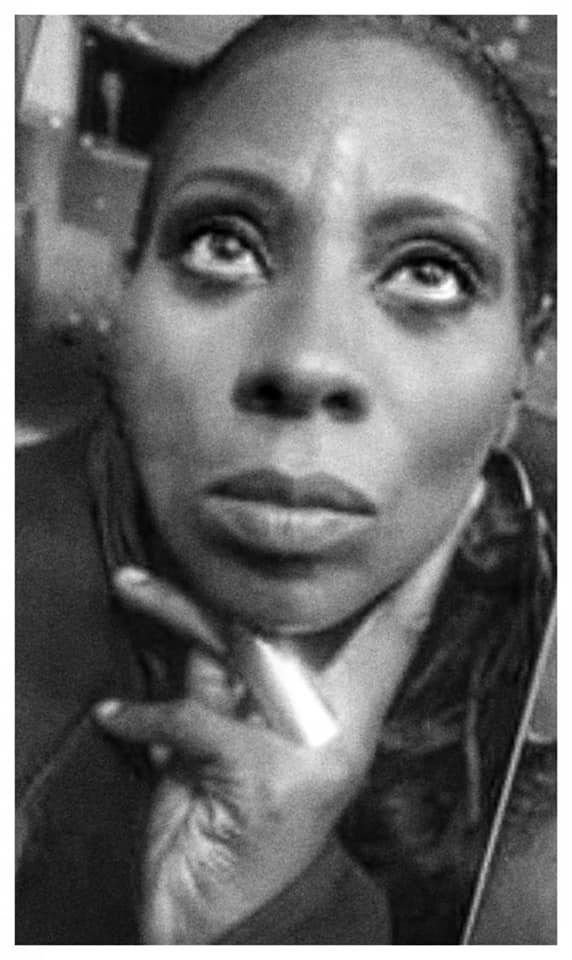

OP / ED & Photos By ANDREA DIALECT

I’ve always prided myself on my free-spirited somewhat nomadic personality tendencies that I have been happily loyal to since I was a snotty-nosed little girl. Before folk would find it quite charming, but hilarious when during our chats I’d boastfully give em’ that peek into my living ways when it came to my eating or sleeping or just being plain ol me – which in our present climate has transformed me into less of a weirdo and more into a Sista who knows how to take that sour lemon with the browning rind and make that banging lemonade.

Now those crazy life stylin’ recipes are constantly being distributed at request. Yet, my minimalistic life of adventure pales in comparison to the days gone by and the soon-to-be unplugged liveaboard life that Mr. Carter will live on his own terms. Just to think that a comfortably adventurous life is a staycation that we all can enjoy. Yep, you & I can be about that life if we want too. Thanks to the lifestylin’ example of Captain Eric. Salute!

AYE AYE CAPTAIN…

I wasn’t looking for this as a lifestyle, but my ex-wife’s cousin happened to buy a boat in Charleston North Carolina; it took her two months to get it up here because it broke down two or three times. When she got it here, she had planned on totally renovating the boat. So, she hired me and my son to renovate it and after being on that boat when it was on that water and that subtle swaying back and forth, I was hooked. I had to find me a boat. – Eric Carter

Boat Name – E’obiacasa – (Eric’s Original Black Indian American House)

THE NEGOTIATOR

“The brief version of my life styling journey begins when I bought my first three-family house in Newark for two thousand dollars which was years ago. It was two thousand dollars because I had to totally rehab the house. Back then there were a lot of vacant houses and I got that one through a HUD auction. I bought my second three-family house in East Orange a couple of years later for fifty-eight hundred. Then I brought a six family in Montclair in Depot Square right across from the Walnut Street Train Station.

“After that I bought a thirty-six-unit building on Ampere Plaza in East Orange for sixty thousand and they took back the mortgage. I didn’t have to apply for a mortgage because at the time Carter was President and the interest rates were 21 percent. So the owners agreed to hold the mortgage and I paid them directly.

“After that, we were riding our bikes one day in upper Montclair and we came across this lot for sale. I brought the lot and built my first house from the ground up in upper Montclair. By that time, I knew quite a bit because I had gotten the experience from renovating those properties, the three-family house in Newark and the three-family that I had in East Orange, and a big portion of the six-family in Montclair.

“My biggest challenge was that I didn’t know how to construct the foundation but after watching a guy for about an hour while he was starting to build a foundation in West Paterson; myself and a high school kid that had just graduated from East Orange high school and my father who was seventy-two at the time. We built the house.

“This house passed code but, originally, I had actually brought a set of plans online for a solar house. It was a corner property and when we applied for the building permit for that house on that property expecting to get a building permit the town for some crazy reason had changed the set back so the building plans we had would no longer fit that lot.

“At that point, we had already had about seventy-five percent of the building material based on that house. What I ended up doing was since it was a one-family house and we were going to be the occupants of that house I was allowed to draw up building plans on my own. So I redrew a different house using the building material that we had and that’s what’s built on that property.

“We stayed in that house for eighteen months. I spent sixty-seven thousand building that house and thirty-five for the lot. We built that house with the money from the sale of the 36-family unit in East Orange. We ended up selling that house for three hundred seven thousand and we bought another house in South Orange for one hundred thirty-five thousand.

“It was a big house, but it wasn’t in the best condition when we bought it. For instance, when you would go into the living room you could see the second-floor bathroom because it was a big hole in the living room ceiling and a big hole in the second-floor bathroom floor and the other bathroom could be seen from the kitchen. So, I fixed that house.

“During those times we owned our home and we also had rental properties until I spread myself thin physically when I started doing building construction jobs for other people. In 2008 or before 08 it got to the point that I was doing 3 or 400,000-dollar jobs in Chatham Township.

“We would stay on a job for a year, and I was getting monthly progress payments of like 35-40 thousand dollars. We were living large. But then ‘08 came which they called a recession, but I called it a depression because I also thought that I was a stock trader.

“I started buying and selling stock and I bought and sold seven million dollars’ worth in stock in 2008 and lost a load of money in the process. Also in 2008, I was going through a divorce, and we decided to sell the house that we bought for 135,000.00 in South Orange for 611,000.00 which was low value because of the depression that was going on at that time.

“So moving forward when I moved out of there when I got the divorce I ended up taking all the tax burden for selling some of the properties that we had and I owed the IRS 263,000.00. Putting the sales of those properties on my tax return allowed her to walk away with some money because I knew that I could always make money. I put in for a discharge and the government discharged it because I had nothing, I had no assets at that time because I didn’t get any money from the closing.

“Soon after I got a job working on a friend of mine’s basement and with the last payment of that basement job, I started buying storage units. I made appearances on the television series Auction Hunters and Storage Wars New York. That’s when I moved into the store. I made a contact during that time, and I was able to buy trailer loads of Home Depot products, Bed Bath and Beyond products, and Wayfair, for ten cents on a dollar so I was able to buy 100,000 worth of products for 10,000 dollars and that’s what I’m closing out now because I’ve moved on to boats.

“I wasn’t looking for this lifestyle but my ex-wife who’s my best friend now. Her cousin happened to buy a big boat in Charleston North Carolina; it took her two months to get it up here because it broke down two or three times. When she got it here she had planned on totally renovating the boat. So she hired me and my son to renovate the boat and after being on that boat when it was in that water and that subtle swaying back and forth I was hooked. I had to find me a boat.

“I’ve done big fishing trips in the past I’ve done fishing trips where we’d be offshore for maybe three days catching big fish. So I was used to being on the water. I’ve caught fish as large as a hundred and seventy-five pound blue finned tuna; which is approximately a six-and-a-half foot long fish. On that trip, I caught around 6 fish.

“I sold that seventy-five pounder Tuna for three hundred dollars to Luigi’s Restaurant in East Hanover, and I kept the other five. I had tuna for the rest of the winter because I had one of those shrink wrapping machines that sucked all the air out at the time and I stored them in the deep freezer. It was nothing for me to come home from work and put a tuna steak on the indoor grill and slap it on a hamburger bun with some relish and ketchup and I ate it like a burger, life was good. But, I haven’t been fishing for probably around ten years now.

“Once I started looking for boats I look for over a year. I got my credit score up. The reason my credit was so low was because when I moved into the store and started buying those trailer loads of merchandise. I was purchasing those trailer loads with credit cards. With the understanding that when I sell the stuff, I would pay the credit cards off which in a large part I did.

“I did this for quite a few years. I was in the store, this makes 8 years. But sometimes you just don’t sell enough of that load by the time you have to pay the bill on the credit card so little by little I started building up a balance.

“Over a period of years, my credit card balance when you added them all up was thirty-five thousand. So what ended up doing was driving Uber for a year and a half and I paid off the debt and my credit score went from 625 to 750. That’s sorta the reason that I thought that I could qualify for a loan. But that didn’t work out too well because they needed two years of tax returns and I only had one good one, which was from Uber.

“The boats that I was looking at were around sixty, seventy thousand easy. I was even dreaming of some boats for around a hundred thousand hoping that I could get a loan but it didn’t work out.

“I found this company in Rhode Island that sold salvaged and repossessed boats and I ended up finding a boat up there that was like something that I wanted. But not knowing if the engines were going to start I walked away from it three or four times and with the price being what it was I called the broker.

“The one concern that I had was that where the boat was the telephone number was disconnected for the marina and that caused me to be cautious because maybe the property was foreclosed on and maybe there were a bunch of fees that were involved if I ended up getting this boat. So I was thinking about making an offer and I told the broker that he had to give me somebody that I could talk to find out what I was responsible for paying if I won the auction on this boat.

“He gave me this guy’s number and the guy that I spoke to was the service manager and I got the number of the person that bought the marina where the boat was now sitting in and he told me if I got the boat out by the end of October I wouldn’t have any fees to pay.

“So, I asked him if he knew anything about the boat and if he knew if the boat runs. He told me that the boat does run because he drove it there. I was the only bidder that knew that. I ended up placing a bid at twenty-thousand-five hundred and the broker called me and the end of that week to tell me that I had won the boat.

“Now the only problem that I had was coming up with the twenty-thousand-five hundred which I had a week to do. Now, remember I had paid off all of my credit cards. So I took one card that had a ten thousand available balance and paid the ten thousand with that card. Eight thousand five hundred was another card and then I put in the difference which was two thousand dollars, and I purchased the boat.

“Once I got the boat, I applied for two new credit cards and transferred the total amount which totaled eighteen thousand dollars to two credit cards. I had to pay a two percent transfer fee but it gave me twenty-one months to pay that eighteen thousand off interest-free.

“Now I’m at a point where I am on track as far as paying those loans off on the date that they mature. I own the boat free and clear because there’s no loan on the boat but soon I will have paid those loans without paying any interest on them. But, I’m back in debt on the credit cards again because I’ve been buying stuff to fix up the boat.

“For now, the boat is docked on the Hudson. The goal is to have my boat water worthy by next April and what I plan to do is to offer the boat for rentals for weddings, small gatherings, and functions. I will be living there. During the winters my goal is to spend the winter in Bimini Bahamas and do the same thing. The boat is capable of sleeping 6 people and I’ll still have my master bedroom.

“If they want to rent the boat for some time then I’ll stay and cook them dinner lol!”

TO BE CONTINUED!

DID YA KNOW THAT…

The principal reason people choose to live part-time or full-time aboard their boat is to escape the distractions that infiltrate their daily lives. While at sea, you can enjoy unlimited privacy without distractions. Strict schedules have no place aboard a boat.

8 things to leave behind when going boating

- Shoes with marking soles

- Spray sunscreen

- Chocolate or other messy snacks

- Cigarettes

- Unexpected guests

- Perfume

- Glass bottles or containers of any kind

- Plastic grocery bags

- GOOGLE THAT TO FIND OUT WHY!

DO YOU KNOW ANY OF OUR COMMUNITY ACCESS CONTRIBUTORS?

If SO LET THEM KNOW THAT THEY’VE MADE THE CUT AND THEY ARE THE TALK OF LOCAL TALK THIS WEEK!

PASS IT ON!

LIKE, COMMENT, SHARE!